How Air India Is Now Tata Airlines With Tata Buying It At 18000 Crores

After a 68-year hiatus, debt-ridden national carrier Air India has been restored to its founders, Tata Sons, putting an end to a decades-long battle to sell the money-losing carrier.

More than half a century after ceding control to the Centre, the salt-to-software conglomerate made a successful bid of Rs 18,000 crore to re-acquire the airline.

The winning proposal comprises a 50 percent share in Air India SATS Airport Services Private Limited, in addition to a 100 percent investment in Air India and its low-cost affiliate, Air India Express (AISATS).

The sale of Air India began in July 2017 and by December of last year, the government had received seven expressions of interest, according to the Finance Ministry’s Department of Investment and Public Asset Management (DIPAM).

According to Tuhin Kanta Pandey, secretary of the DIPAM (the government body in charge of privatization), an SPV of Tata Sons – the conglomerate’s holding company – was the victorious bidder.

Tata Sons won Air India over SpiceJet’s promoter.

Air India gives Tata Group a third airline brand to add to its portfolio, as the company already owns a controlling stake in AirAsia India and Vistara.

According to the DIPAM secretary, Tatas’ 18,000 crore proposal includes taking over 15,300 crores in debt and paying the remainder in cash. Both bids exceeded the reserve price, he said, adding that the sale will be completed by December.

The winning proposal comprises a 50 percent share in Air India SATS Airport Services Private Limited, in addition to a 100 percent investment in Air India and its low-cost affiliate, Air India Express (AISATS).

The sale of Air India began in July 2017 and by December of last year, the government had received seven expressions of interest, according to the Finance Ministry’s Department of Investment and Public Asset Management (DIPAM).

Air India is in debt to the tune of about 60 crore rupees.

According to the Air India EoI filed by DIPAM in January last year, the buyer would be needed to absorb 23,286.5 crores of the airline’s total debt of 60,074 crores as of March 31, 2019.

The balance will go to Air India Assets Holding Ltd (AIAHL), a special purpose entity.

Since its merger with local carrier Indian Airlines in 2007, Air India has been losing money.

The airline will hand up 4,400 domestic and 1,800 international landing and parking spaces at domestic airports, as well as 900 slots at foreign airports, to the winning bidder.

In addition, the winning bidder would receive 100% of Air India Express’s low-cost arm and 50% of AISATS, which offers cargo and ground handling services at key Indian airports.

History of Air India

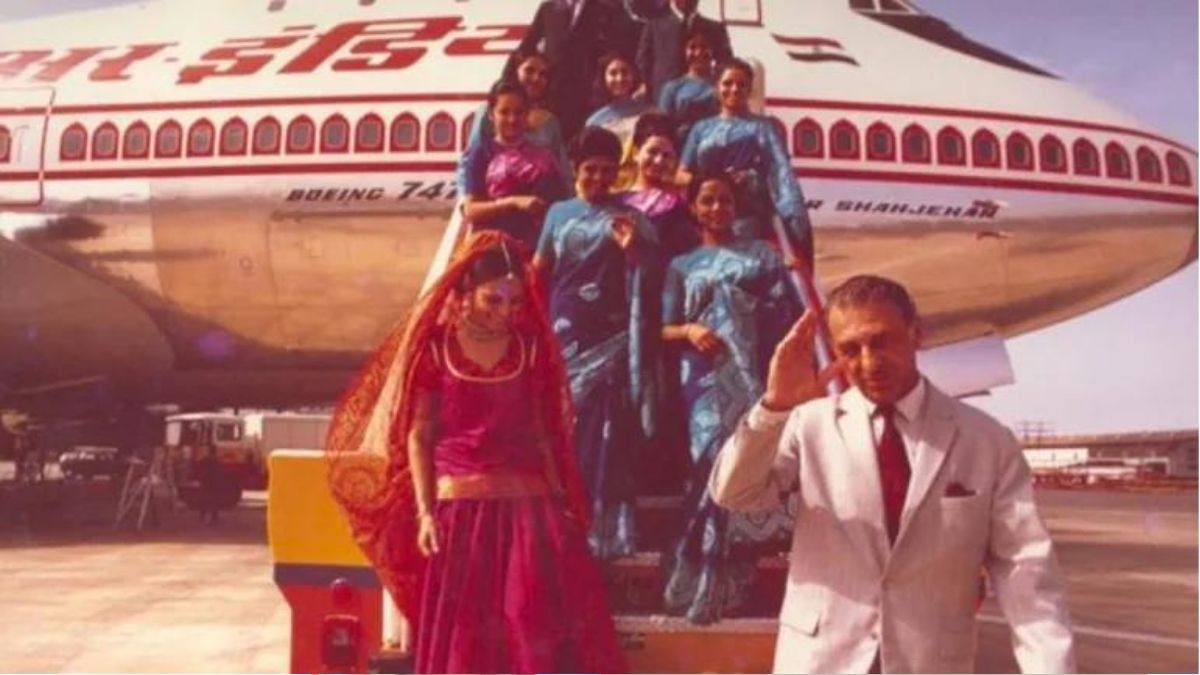

This is the first time Air India has returned to the Tatas. The airline was created in 1932 by Jehangir Ratanji Dadabhoy (JRD) Tata. Tata Airlines was the name at the time.

Tata Sons’ aviation branch was registered as Air India in 1946, and Air India International began flying to Europe in 1948.

The international service was one of India’s earliest public-private partnerships, with the government owning 49 percent, the Tatas 25 percent, and the balance owed by the general public. In 1953, Air India was nationalized.

Due to the continuing coronavirus epidemic, the share sale procedure, which began in January 2020, was delayed.

The government requested financial proposals from possible bidders in April of this year. The deadline for submitting financial proposals was September 15.

The Tata Group was one of many companies that submitted an initial expression of interest (EoI) for the Maharaja in December 2020.