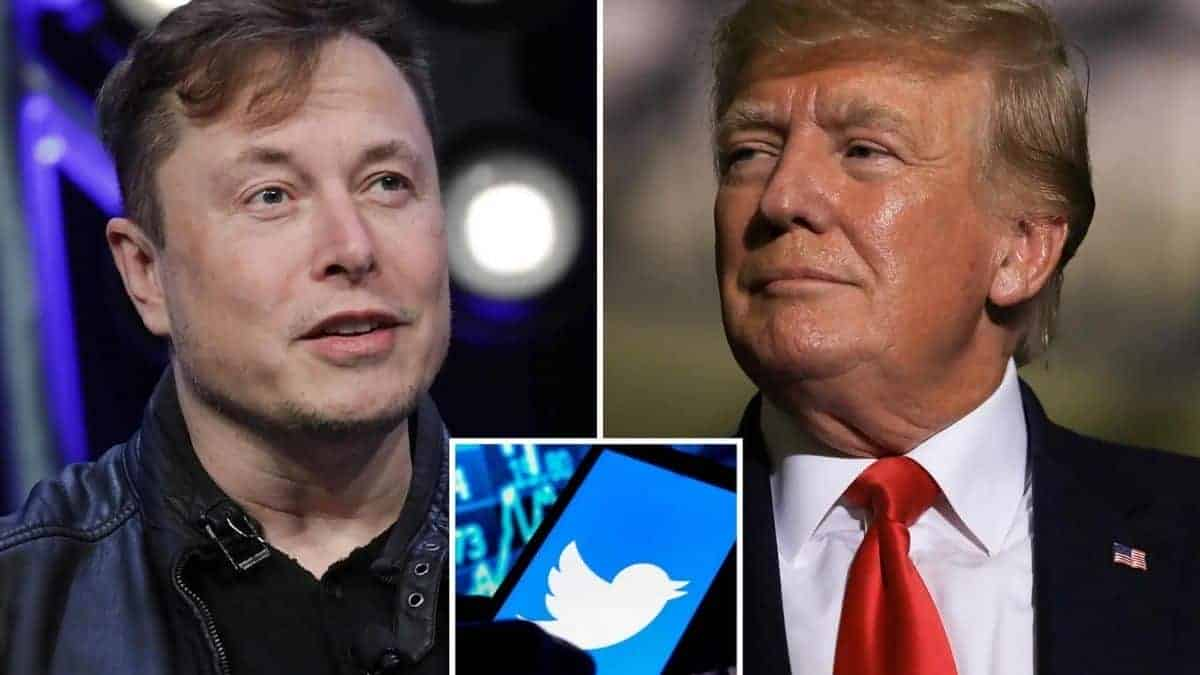

Elon Musk Is The Latest Stumbling Block For Trump’s Truth Social

Elon Musk has acquired $46.5 billion (£35.6 billion) in finance for a potential hostile takeover of Twitter, with Musk contributing $21 billion of his own money as part of the deal.

Musk is also financing an additional $12.5 billion for the offer through a margin loan secured against his shares in Tesla, the electric carmaker he leads as CEO. Morgan Stanley, a major investment bank in the United States, is coordinating a group of financial institutions that will provide $13 billion in debt financing.

The funding pledges were detailed in a filing with the Securities and Exchange Commission in the United States on Thursday. The paper stated that the world’s wealthiest man was “considering whether to launch a tender offer” for the Twitter shares he did not own. Musk already owns 9.2 per cent of the company and just announced a $54.20-per-share proposal.

A tender offer is considered a hostile bid since it bypasses the company’s board of directors, which would normally suggest an offer to shareholders in a traditional takeover situation. Instead, Twitter’s board of directors has taken steps to prevent Musk from expanding his stake in the company without its approval.

Last week, Twitter filed a so-called poison pill defence against Musk’s bid, aiming at preventing him from owning more than 15% of the company. If anyone tries to buy more than 15% of Twitter without the board’s approval, the method, which is often used by company boards as a bulwark against unwanted advances, will allow existing investors to buy shares at a steep discount.

This would diminish an undesired bidder’s equity and would be a severe roadblock to any non-board-approved bid. Shareholders who embrace Musk’s strategy, on the other hand, may force the board to abandon the poison pill strategy.

Musk, who has over 82 million Twitter followers and is a frequent user of the network, hinted at the weekend that a compassionate approach was being considered.

Apart from publicizing the poison pill action, Twitter has yet to reply formally to Musk’s $43 billion deal.

Musk, a self-described “free speech absolutist,” has stated that the microblogging service does not give users complete freedom. In a letter to the board last week, he said Twitter was “the platform for free speech around the world,” but that it couldn’t meet this “societal imperative” in its present form and “has to be reinvented as a private corporation.”

Before announcing his takeover offer, Musk hinted at several changes he would make to Twitter, some of which are more likely than others, such as adding an edit feature to tweets and turning the company’s headquarters in San Francisco into a homeless shelter. The last suggestion, which Musk later removed, was backed up by Jeff Bezos, the world’s second-richest man, in a tweet.

In response to Musk’s recent filing, Twitter’s stock increased 0.5 per cent to $46.95.

Musk’s funds set aside for a potential Twitter takeover are less than the $23 billion bonus he is slated to receive from Tesla following the electric car company’s record quarterly profits.

Because Tesla met share price and financial growth milestones in its earnings on Wednesday night, Musk, who is already worth an estimated $249 billion, is in line for the bonus share payout.

This latest hurdle for the Truth Social app, which Donald Trump has framed as Twitter’s freewheeling conservative counterpart, is Elon Musk’s idea for a potential hostile acquisition of the social media platform.