Best Buy Co.: Revenue in the First Quarter Exceeds Expectations

As per the recent news floating around the internet, it claims that Best Buy’s first-quarter revenue exceeded analysts’ forecasts, but the business couldn’t escape joining the list of retailers who have lowered their full-year forecasts. The results provided some respite to investors as US retailers battle to maintain profit margins as costs rise and customers face the highest inflation rates in four decades.

Even though the quarter was predicted to be bad as the US economy digested government stimulus in early 2021, Best Buy avoided the steep earnings declines experienced by some other retailers. However, with the predicted downturn this year, Chief Executive Officer Corie Barry stated in a statement that they are in a substantially healthier position than they were before the epidemic in terms of revenue and operating income rate.

We also came to know from the sources that Best Buy lowered its yearly earnings, revenue, and same-store sales forecasts due to the worsening economic environment. The company also lowered its operating profit forecast to between 5.2 percent and 5.4 percent of revenues, down from 5.4 percent before.

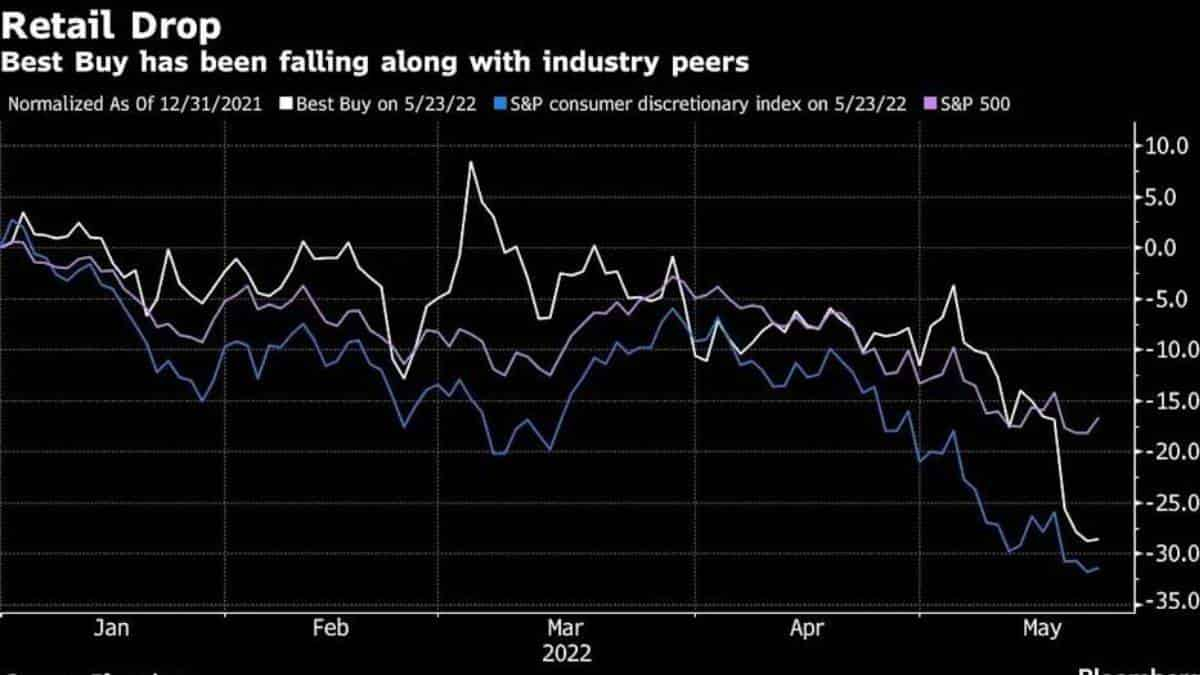

Best Buy was down 2.2 percent at 8:27 a.m. in New York, erasing a 10-percent gain ahead of regular trade. The stock had been down 29% this year through Monday, while the S&P 500 index of consumer discretionary stocks had dropped 31%. Adjusted profits per share fell to $1.57 in the first quarter, below the $1.60 average of analyst projections polled by Bloomberg. Comparable sales dropped 8%, whereas analysts had predicted a 9.4% drop.

As per the sources, it states that Best Buy seems to do better than the giant discounters and department stores, whose disappointing results roiled markets last week. Petco Health and Wellness Co. reported better-than-expected adjusted earnings and sales on Tuesday, leading its shares to rise more than 6% in premarket trading after being widely shorted by investors.

Furthermore, AutoZone Inc.’s comparable sales in the third quarter were higher than projected by Wall Street. Investors have recently been betting against the company, which is down 14% year to date as of Monday’s close.