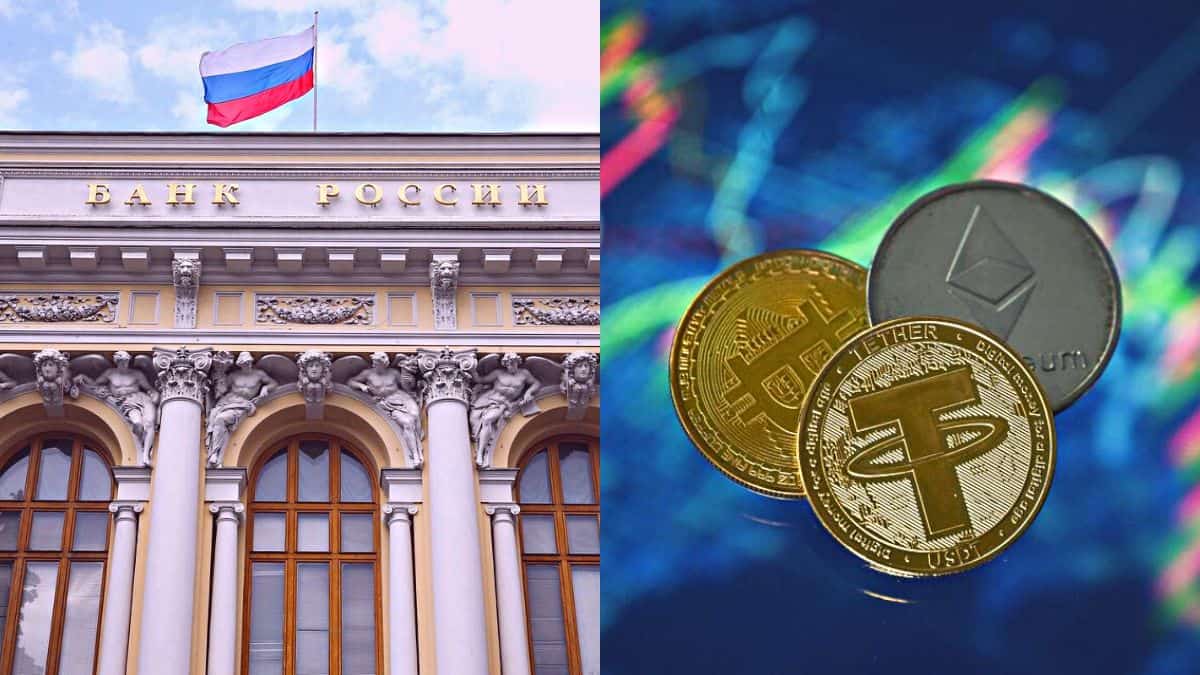

Central Bank of Russia says Stablecoins are not appropriate for Russian Federation

Central Bank of Russia (CBR) reported that the cryptocurrency called stablecoin is not intended for settlements either with Russian Federation or abroad. Stablecoins are cryptocurrencies that are designed to be pegged to a cryptocurrency, fiat money, or to exchange traded commodities such as industrial metals or gold, etc.

The CBR believes that the issuance and use of private stablecoins can become a high-risk venture to its associated assets since it is not pegged to a fixed holder. As the crypto news outlet Bits.media says, “Therefore, redemption at the nominal price of the assets in collateral is not guaranteed, and the price of a stablecoin is not actually stable.”

According to a statement by the Financial Policy Department’s head Ivan Chebeskov, “If there is a need for companies and investors to pay or invest in a new way, if they need such a tool because it reduces costs, works better than previous instruments, and if the risks associated with it can be limited, then we will always support such initiatives.”

The head finance minister reported that the stablecoins are right now pegged to the U.S. dollar to strengthen its fiat currency. However, stablecoins pegged to the Russian ruble could not be issued for fear of it being a weak currency against the dollar.

Andrey Voronkov who is the founder of Voronkov Ventures confirmed that there is no existence of blockchain-based Russian ruble stablecoin as of yet.

However, a national economic development institute called VEB.RF’s expert said that if stablecoins can be backed by gold for an international settlement then the Russian federation can think of a way to utilize it amid Western sanctions. Since stablecoins pegged to Western fiat currency are not suitable economically for Russia amid heavy sanctions due to the Russia-Ukraine war.

Reportedly, the Bank of Russia is actively developing a digital version of the Russian fiat currency. The Russian Deputy Governor said that CBR is prompting trials for the digital ruble both within the country and in international sanctions.

Russia has been actively testing and developing a Central Bank Digital Currency (CBDC) which is a digital token backed by the Russian Central Bank and is pegged to the Russian ruble in order to elevate the economy amid the Russian invasion of Ukraine.