USA Treasury has disputed finding that IRS fund could increase taxes of middle class

As far as a political messaging war rages over $80 billion in new IRS (Internal Revenue Service) funding, an American Treasury official is pushing back on an informal estimation that the money could cause American people earning less than $400,000 to pay as much as $20 billion more in taxes over a decade.

The Republicans have seized on the Congressional Budget Office (CBO) estimate, claiming that President Joe Biden who recently enacted, sweeping tax, drugs and climate law would not break his pledge to increase taxes on middle-class Americans.

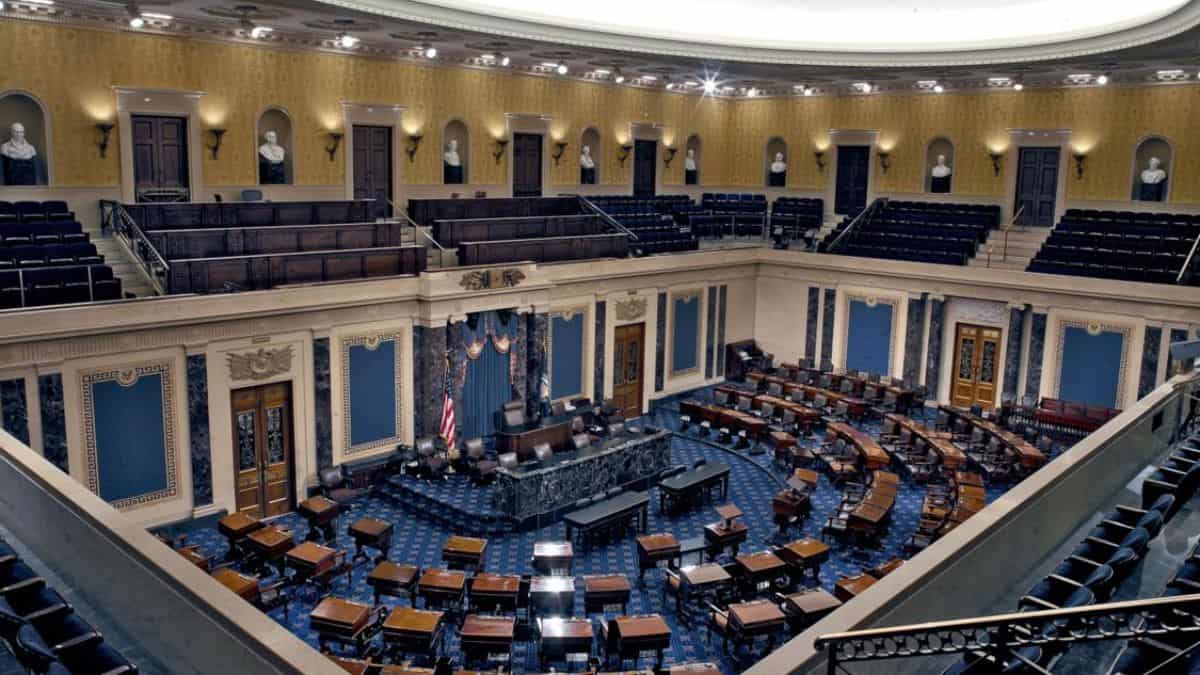

When the bill, officially known as the Inflation Reduction Act, was being spoken in the Senate, Republican Senator Mike Crapo introduced an amendment which prohibits any sort of funds to audit Americans with taxable incomes below $400,000.

Moreover, the proposed amendment would reduce revenues by $20 billion over a decade if it was enacted, said office officials of Mike Crapo. The amendment was refused on a party-line vote.

“The CBO estimate assumed a threshold of $400,000 in reported taxable income before any audits, which would exclude the middle class”, claimed Natasha Sarin, Treasury Department counselor for tax policy and administration.

The people making $400,000 and above include far wealthier people who have hidden their incomes to lower taxable incomes below $400,000, sometimes even to zero — the very people the Treasury is seeking to target for audits, added Sarin.