The Impact of DMS in Modernizing Lending Transformation

“If you embark on the journey of digitization without first addressing the complexities of manual documentation, you may unknowingly create a bottleneck nightmare that hampers efficiency and impedes progress. Fortunately, the synergy between Document Management Systems (DMS) and Lending Modernization directly confronts this problem.”

It wouldn’t be wrong to say that navigating through piles of paperwork can be a real challenge. However, there’s a powerful solution at hand: a seamless integration of Document Management Systems (DMS) with Digital Lending.

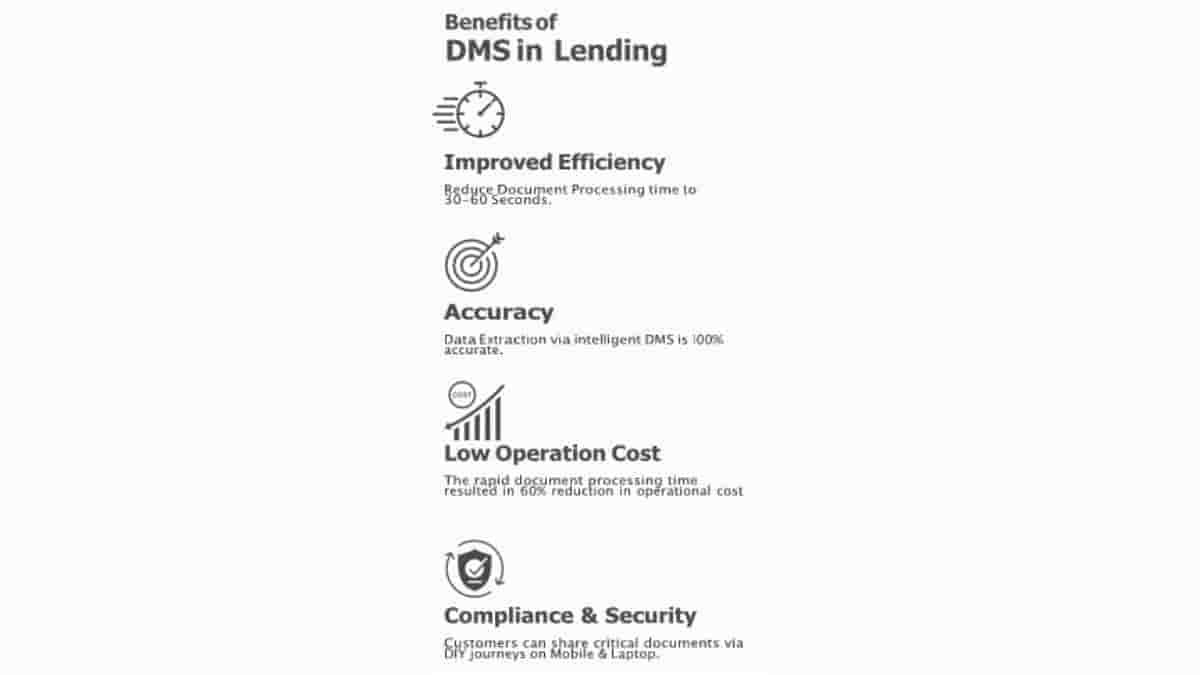

DMS, with its cutting-edge API capabilities, seamlessly merges with lending operations, offering a holistic approach to document management. By teaming up, DMS and Lending Modernization revolutionize the process, eliminating manual tasks associated with document handling. The result? Faster loan processing, increased accuracy, and an elevated customer experience.

There should be more to it than just storage, don’t you think? With intelligent indexing and search functions, finding relevant documents becomes a hassle-free task, saving time and effort. This transformative approach not only streamlines operations but also equips lenders with instant access to vital information, thus reducing the time it takes to review, approve, and make informed decisions swiftly amid larger volumes of loan applications.

“A successful lending digitization demands meticulous attention to the foundation of manual documentation, ensuring seamless Archiving, Indexing and Retrieving amid Advanced Encryptions & Security.”

Integrating DMS with lending practices optimizes the entire document management lifecycle. From collecting and verifying documents to processing them seamlessly, DMS revolutionizes each step, minimizing errors, and cutting operational costs. This smooth workflow leads to quicker loan processing, allowing lenders to serve customers better.

Moreover, DMS enhances accuracy by automating workflows and reducing manual data entry. This lowers the risk of errors, improving operational efficiency and ensuring reliable information for decision- making, thus reducing risks.

In the competitive lending industry, customer experience is key. DMS, alongside Lending Modernization, enables lenders to offer a seamless, personalized experience. With simplified applications, efficient communication, and easy document access, borrowers enjoy a delightful lending journey.