As US Inflation jumps to 9.1% Netizens are showing their anger on twitter

The US inflation rate increased more than expected in June, highlighting the ongoing price pressures that will put the Federal Reserve on track to raise interest rates further later this month.

According to data released by the Labor Department on Wednesday, the consumer price index increased 9.1 percent from a year earlier in a broadly based increase, marking the biggest increase since 1981’s end. The widely used inflation indicator jumped by 1.3 percent from one month earlier, which is the highest increase since 2005 and reflects rising petrol, housing, and food prices.

Based on the Bloomberg survey medians, economists predicted a 1.1 percent gain from May and an 8.8 percent increase from year-to-year.

Above expectations, the so-called core CPI, which excludes the more erratic food and energy components, increased by 0.7 percent from the previous month and by 5.9 percent from a year earlier.

Following the report, the currency and Treasury yields increased, while US stock futures decreased.

The sky-high inflation rates confirm that pricing pressures are pervasive and rampant across the economy, continuing to erode consumers’ purchasing power and trust. In addition to increasing pressure on President Joe Biden and congressional Democrats, whose support has fallen ahead of the midterm elections, this will keep Fed officials on an aggressive policy course to restrain demand.

While many economists believe that these figures mark the apex of the current inflationary cycle, other factors, such as the property market, may prolong the period of high price pressure. Supply chains and the forecast for inflation are also at danger from geopolitical issues like Covid lockdowns in China and Russia’s conflict in Ukraine.

In response to ongoing inflation as well as ongoing good job and pay growth, Fed policy makers have already indicated a second 75 basis-point increase in interest rates later this month. Traders had fully priced in a three-quarter percentage-point increase for July even before the figures were made public.

Last month, the cost of basic essentials continued to rise dramatically. In June, gas prices increased 11.2 percent over May. Prices for energy services, such as electricity and natural gas, rose by 3.5 percent, which is the highest increase since 2006. In contrast, the cost of food increased by 1 percent and 10.4 percent from a year earlier, the highest increase since 1981.

Early financial reports from PepsiCo Inc. demonstrate that some businesses are still able to weather recent increases in commodity prices. In the second quarter, the manufacturer of Mountain Dew and Fritos was able to raise prices by an average of roughly 12%. However, according to the corporation, volume has held up well.

The primary residence’s rent increased by 0.8 percent from May, marking the biggest monthly increase since 1986. Overall, the cost of housing increased by 0.6 percent, matching the previous month. Housing costs are the largest services component and account for one-third of the CPI index.

Because it takes time for price adjustments to reflect in the CPI, experts anticipate that rental inflation will continue to rise even though home sales have slowed recently as a result of increased mortgage rates.

Early financial reports from PepsiCo Inc. demonstrate that some businesses are still able to weather recent increases in commodity prices. In the second quarter, the manufacturer of Mountain Dew and Fritos was able to raise prices by an average of roughly 12%. However, according to the corporation, volume has held up well.

The primary residence’s rent increased by 0.8 percent from May, marking the biggest monthly increase since 1986. Overall, the cost of housing increased by 0.6 percent, matching the previous month. Housing costs are the largest services component and account for one-third of the CPI index.

Because it takes time for price adjustments to reflect in the CPI, experts anticipate that rental inflation will continue to rise even though home sales have slowed recently as a result of increased mortgage rates.

That sounds about right #inflation pic.twitter.com/kWyM9uQITb

— Cointelegraph Markets (@CointelegraphMT) July 5, 2022

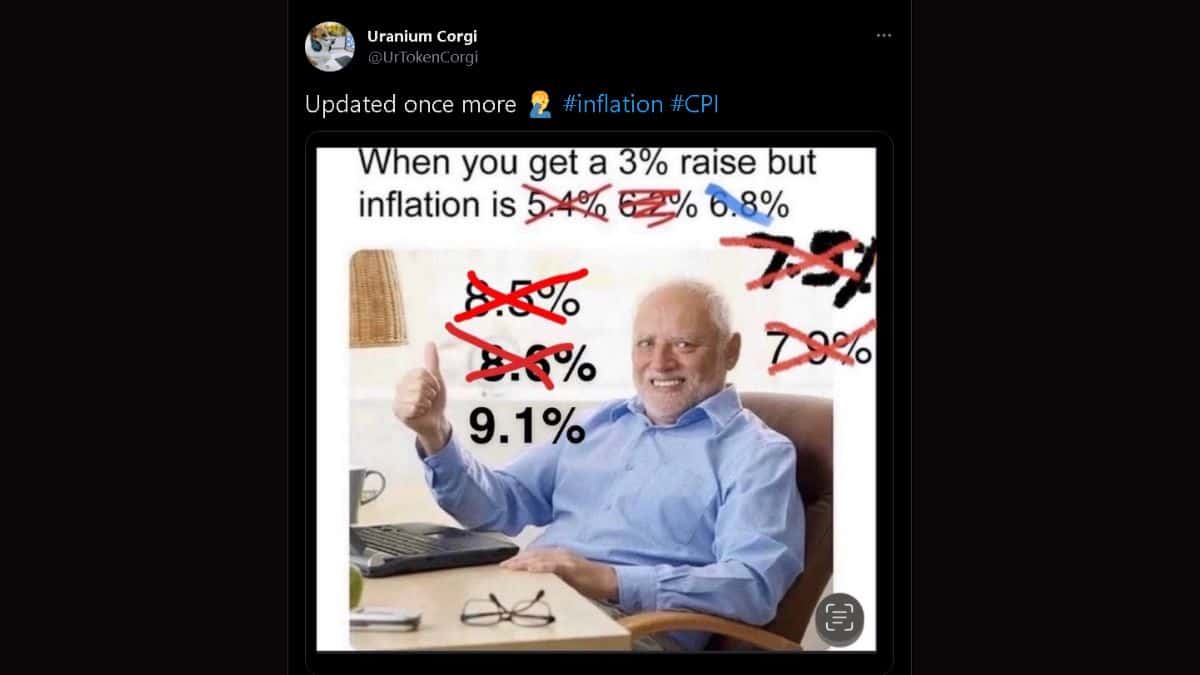

Updated once more 🤦♂️ #inflation #CPI pic.twitter.com/ExbrCgbb9c

— Uranium Corgi (@UrTokenCorgi) July 13, 2022