India’s smartphone market grew 4% in 2024, Apple enters top 5 with record 12 million shipments as vivo takes market leadership

India’s smartphone market showed resilience in 2024, achieving a 4% year-over-year growth with total shipments reaching 151 million units, according to IDC’s recent Worldwide Quarterly Mobile Phone Tracker report released in February 2025. The market’s growth was primarily driven by a strong first half performance of 7%, which helped offset the slower 2% growth in the second half of the year.

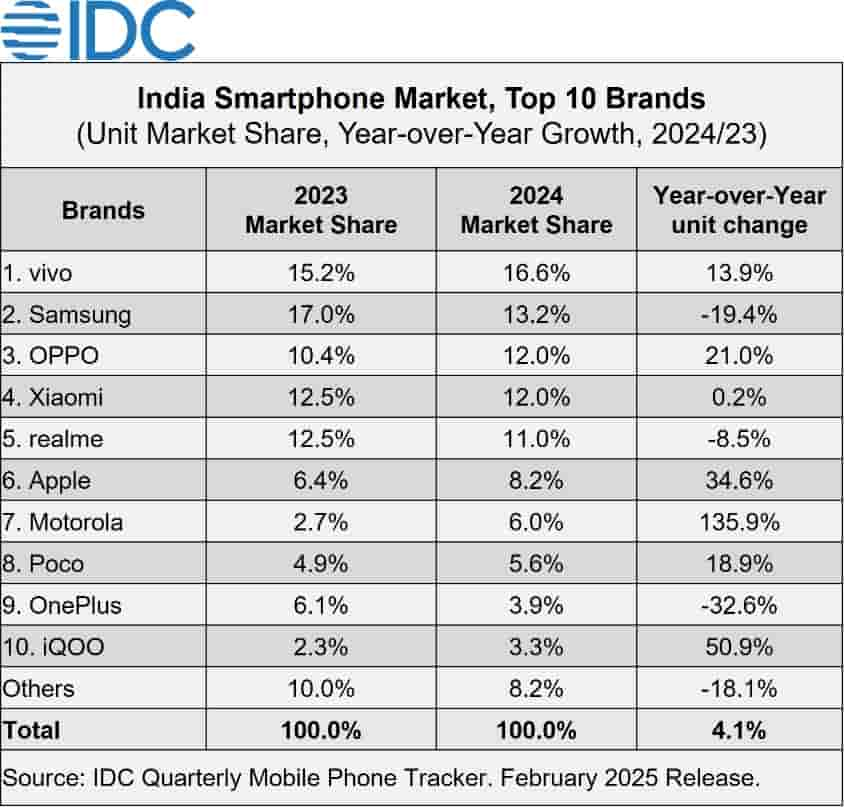

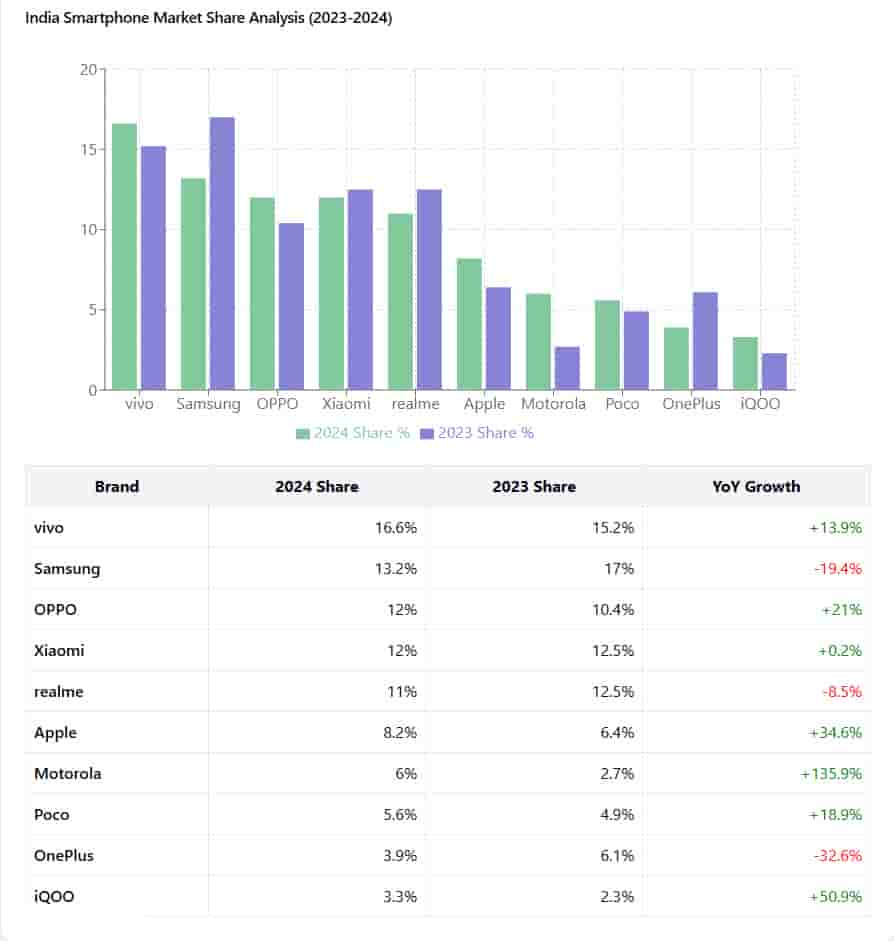

Vivo emerged as the market leader with a 16.6% market share, showing a robust YoY growth of 13.9%, up from 15.2% in 2023. Samsung dropped to second position with its share declining from 17.0% to 13.2%, marking a significant -19.4% YoY decline. OPPO showed strong growth of 21.0% to reach 12% market share, tying with Xiaomi, which maintained relatively flat growth at 0.2%. Realme rounded out the top five with 11% market share, though experiencing an -8.5% YoY decline.

The fourth quarter of 2024 saw a cyclical dip with shipments of 36 million units, marking a 3% decline after five consecutive quarters of growth. Apple achieved a significant milestone by entering India’s top 5 smartphone brands for the first time, securing a 10% market share in Q4 2024. Overall, Apple’s market share grew from 6.4% to 8.2% in 2024, marking a 34.6% year-over-year growth.

India became Apple’s fourth-largest market globally in 2024, following the United States, China, and Japan. The tech giant recorded impressive shipments of 12 million units, representing a 35% year-over-year growth. The iPhone 15 and iPhone 13 were the most popular models, collectively accounting for 6% of overall shipments during the fourth quarter.

“The vendors and channel partners continued to provide price cuts, discounts, and extended device warranties in the post-festive period in 4Q24. While financing options were available across price segments, its impact was more pronounced in mid-range and premium devices throughout the year, with the ‘No Cost EMIs’ for up to 24 months being most popular,” said Upasana Joshi, senior research manager, Devices Research, IDC Asia Pacific.

Among other notable performances, Motorola showed remarkable growth of 135.9%, increasing its market share from 2.7% to 6.0%. Poco grew by 18.9% to reach 5.6% market share, while iQOO demonstrated strong performance with a 50.9% growth, reaching 3.3% market share. OnePlus experienced the steepest decline of -32.6%, dropping from 6.1% to 3.9% market share. The “Others” category saw an -18.1% decline, reducing their collective share from 10.0% to 8.2%.

Looking ahead to 2025, Navkendar Singh, associate vice president, Devices Research, IDC India, notes: “With a low single-digit growth in 2024, growth in 2025 hinges on a stronger performance in the mass segment (US$100<US$200) and more offerings in the entry-premium segment (US$200<US$400) for upgraders. Generative AI features and use cases will start being key differentiators, moving beyond flagship models and becoming more prevalent across different price points.”