Investing in Finance Companies: Maximizing Returns with Fin Nifty

The Finnifty consists best financial institutions and companies listed on the NSE to provide a comprehensive view of India’s financial sector. The index allows investors to capitalize on finance stocks and also offers liquidity and transparency. In this article, we will explore the ins and outs of Finnifty, what are its core advantages and how it maximizes returns. Let’s get started.

What is Finnifty?

Fnnifty, also known as Nifty Financial Services, is a share market index that comprises 20 financial stocks from various financial institutions and companies listed on the National Stock Exchange.

The selection of these stocks occurs based on their free-floating market capitalisation. At the heart of the Finnifty index is to provide investors a glimpse into the financial sector performance in India together with a benchmark of the growth of the sector.

Some of the top companies holding a place in the Finnifty index include HDFC Bank Ltd., ICICI Bank Ltd., Kotak Mahindra Bank Ltd., State Bank of India, Axis Bank Ltd., Bajaj Finserv Ltd., Housing, Development Finance Corporation Ltd., HDFC Life Insurance Company Ltd, etc.

Why Invest in Finnifty?

Here are the benefits of investing in Finnifty.

Capital Appreciation

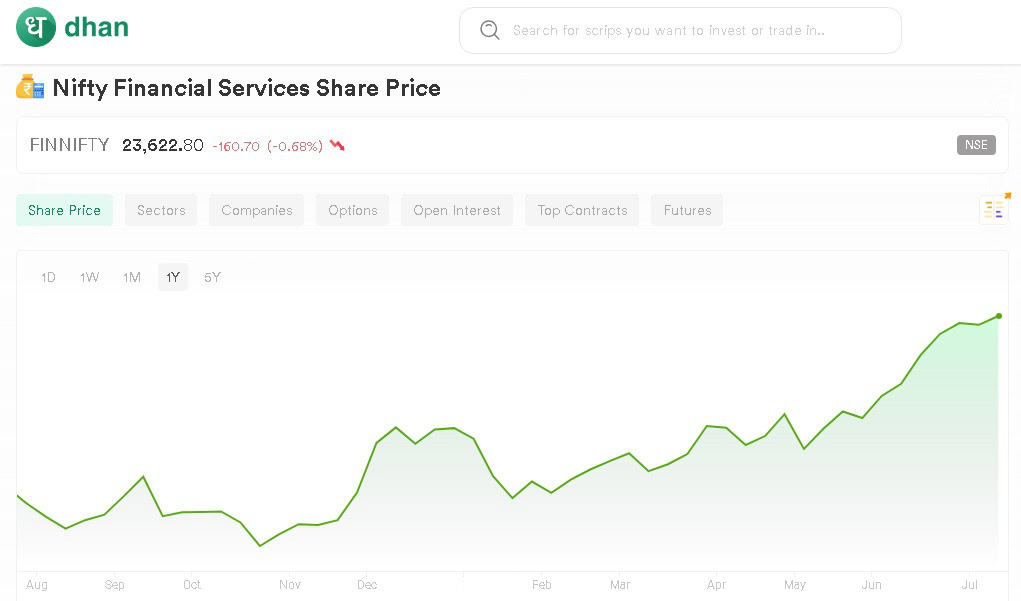

Finnifty is among the top-performing indices in India that have been on the rise through the years. The Finnifty share price on 30 December 2021 was INR 17,116.55 and rose to INR 21,650+ by June 2024.

As a result, investors can increase their return by investing in financial securities associated with Finnifty. Here is how investing in Finnifty can prove beneficial and help in maximizing returns:

Portfolio Diversification

Investing in stocks of a particular company makes investors prone to risk in case the stock value goes down. As against this, the financial securities associated with Finnifty are diversified compiling 20 stocks of the index from various backgrounds like insurance, banking, etc. As a result, there is reduced risk and a higher chance of maximizing returns.

Transparency

The Finnifty performance is included in an index available to the public. It assists investors in getting knowledge about the performance of all Finnifty companies and making informed decisions to maximize their returns.

Liquidity

The Finnifty index allows a great degree of liquidity to its investors and ensures they can easily buy and sell shares in the market whenever they want. As a result, the investors can make informed decisions quickly without a significant impact on the market price. The returns get maximized with the help of swift investor action in the Finnifty index.

These reasons make Finnifty one of the best options for investors looking to reap good returns in the financial market.

Conclusion

Nifty financial services present an opportunity for investors to invest in the best financial companies while also maximizing returns with the advantages of diversified portfolios, transparency and liquidity. If you are looking to invest in finance companies and maximize your returns, you can consider Dhan, one of the best online trading and investment platforms.