LIC offers the opportunity to revise the lapsed policy

According to the press released, Policies which exist in a lapsed situation during the premium paying period and not finalized policy term, are able to be renewed in this movement, which will start from February 7 and on March 25, 2022.

IPO-bound Life Insurance Corporation of India has inaugurated a movement for renewal of personal lapsed agreements.

According to the press released, Policies which exist in a lapsed situation during the premium paying period and not finalized policy term, are able to be renewed in this movement, which will start from February 7 and on March 25, 2022.

As the existing Covid-19 pandemic condition has emphasised the want for mortality insurance, this movement is a good chance for LIC’s policyholders to renew their policies, rebuild life cover and assure financial safety for their household.

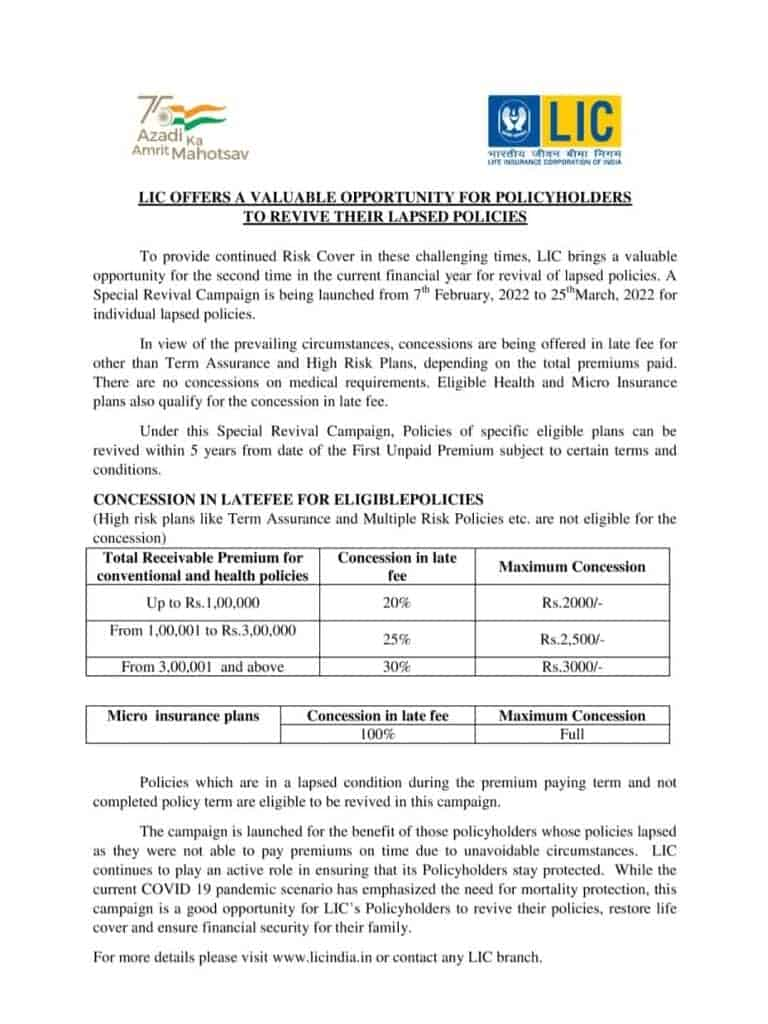

Directly, the concessions in late fees for the eligible policies as following

1) Up to Rs 1,00,000 – Concession of 20% up to Rs 2000 maximum concession