MTNL Defaults on ₹5,726 Crore Loans to Public Sector Banks

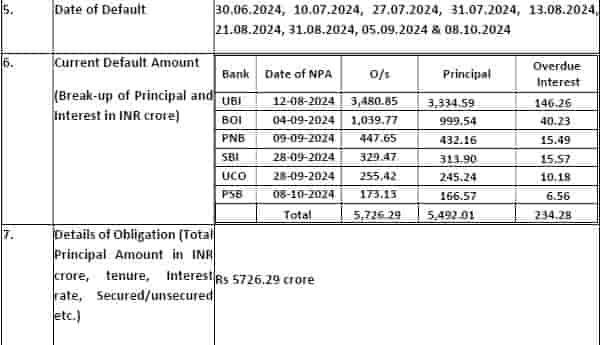

Mahanagar Telephone Nigam Limited (MTNL), the state-owned telecommunications service provider, has disclosed defaults on loan payments totaling ₹5,726.29 crore to six public sector banks, marking a significant deterioration in its financial health. The defaults span multiple dates from June to October 2024, according to a regulatory filing to the stock exchanges.

Union Bank of India (UBI) faces the largest exposure with outstanding dues of ₹3,480.85 crore, of which ₹3,334.59 crore is principal and ₹146.26 crore is overdue interest. The account was classified as NPA on August 12, 2024. Bank of India follows with total dues of ₹1,039.77 crore, while Punjab National Bank has exposure of ₹447.65 crore.

The default breakdown across other banks includes:

- State Bank of India: ₹329.47 crore (₹313.90 crore principal, ₹15.57 crore interest)

- UCO Bank: ₹255.42 crore (₹245.24 crore principal, ₹10.18 crore interest)

- Punjab and Sind Bank: ₹173.13 crore (₹166.57 crore principal, ₹6.56 crore interest)

The telecom operator’s total financial indebtedness, including both short-term and long-term debt, stands at ₹32,097.28 crore, with total outstanding borrowings from banks and financial institutions at ₹8,026.29 crore.

The series of defaults occurred between June 30 and October 8, 2024, with different banks classifying MTNL’s accounts as non-performing assets (NPAs) on various dates. This development raises concerns about the company’s ability to service its substantial debt obligations and highlights the ongoing challenges faced by the state-run telecom operator in an increasingly competitive market.