Prior to the 5G auctions, 7.5 million Indian customers turn off their second SIM cards with Airtel and Jio

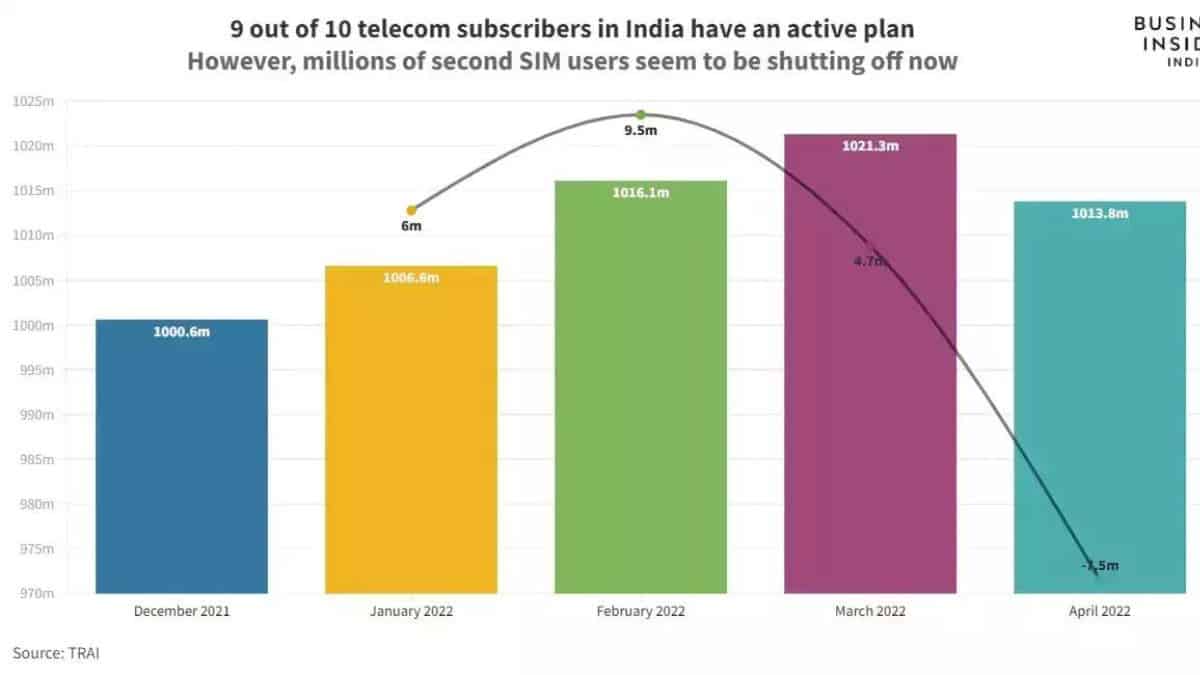

The Indian telecom market appears to be declining. Up to 7.5 million users left the networks in the month of April, but it’s quite improbable that that many people are giving up on this crucial service, therefore this is the second SIM that customers are deactivating.

Since leading telecommunications like Airtel and Reliance Jio have really been actively screening out non-paying consumers by sending them repeated reminders to subscribe to an effective plan, it is unknown if it is voluntary or not. Subscribers’ numbers have been disconnected as a result of failure to comply.

The majority of Indian users, who are cost-conscious, now find it difficult to afford a second SIM because all three telecoms have raised their rates by approximately 20–25 percent in the last few quarters.

However, according to figures provided by regulator TRAI, Airtel and Jio jointly added 2.5 million users for the month, so they have nothing to lose.

Every telecom company in the nation, including the public listed company like BSNL, lost their active subscribers in April, as per TRAI data. This is unusual since even when other telecom companies lose consumers, at least one or two continue to add active customers.

This is a rapid shift considering that Indian carriers added 21 million active users in the first 3 months of 2022, while April saw a dip.

Prior to the 5G spectrum auctions, a maintenance is being conducted

They are eliminating non-paying customers to free up their networking and other resources. In preparation for the 5G spectrum auctions, this gives the telecoms an opportunity to minimize deadweight on their systems and free up essential resources.

After a range of telecom operators surged and the market was inundated with new offers and plans, the concept of second SIMs began to gain traction around 2010. India’s telecom connections once surpassed the country’s population in size.

Later, consumers switched to second SIMs to take advantage of good data plans and service, but all of this put a strain on telecom providers as average spends or ARPU dropped.

With a 1.5 million customer loss, Vodafone Idea seems to be unable to stop the tide. In the last 12 months, it has now lost roughly 23 million customers.

All telecom operators have an average of 9 out of 10 active subscribers. Over a billion telecom consumers have active subscription plans in total.