SEBI partners with DigiLocker to reduce unclaimed assets in the Indian securities market and enhances investor protection

DigiLocker- a digital wallet by the Govt of India that lets you store and access e-docs like Aadhaar, PAN, DL, birth/death certificates, insurance, bank & NPS statements anytime, anywhere. Few days back, SEBI issued a circular that was titled “Harnessing DigiLocker as a Digital Public Infrastructure for Reducing Unclaimed Assets in the Indian Securities Market.” SEBI circular will come into effect from April 01, 2025.

This circular addressed the issue of unclaimed financial assets. This partnership between SEBI and DigiLocker enabled investors to now store and access information on their demat and mutual fund holdings through DigiLocker.

Big update on DigiLocker

- DigiLocker users can now store and access their statement of holdings for shares and mutual funds units from their demat accounts, along with their Consolidated Account Statement (CAS). This expands existing DigiLocker services, which already include bank account statements, insurance policy certificates and NPS account statements.

- Users can appoint Data Access Nominees within the DigiLocker application. In the event of user’s demise, these nominees will be granted read only access to the DigiLocker account, ensuring that essential financial info is easily accessible to legal heirs. You must provide nominees mobile number and email while adding them.

- Upon notification of the user’s demise by KYC Registration Agencies (KRAs)- which are registered with and regulated by SEBI, the DigiLocker system will automatically notify the Data Access Nominees. This access is expected to facilitate the initiation of the transmission process with relevant financial institutions.

How are the nominees informed about the user’s demise?

- DigiLocker retrieves info from the death register or KYC registration agencies.

- It automatically notifies nominees via SMS & email.

- Nominees can verify their identity and access the deceased’s financial information through their DigiLocker account

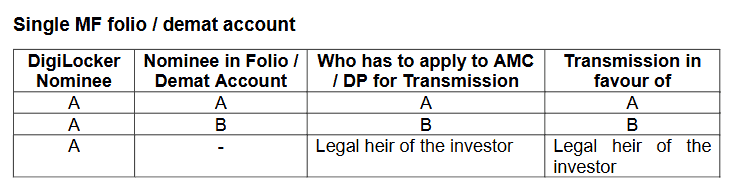

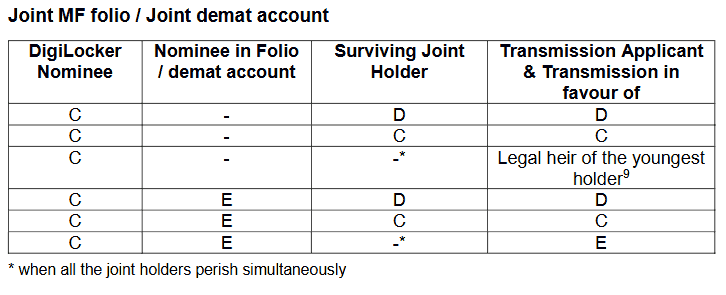

If the DigiLocker nominee is also the nominee in the investor’s account/folio, they can directly initiate the transmission process. Otherwise they can share the information with the joint holder nominee, or legal heir to let them start the transmission process. Also the DigiLocker nominee cannot replace the nominee set by the user for mutual fund folios or demat account.

In case of a joint account, the surviving joint holder will have the right over the deceased user’s assets while the DigiLocker nominee is expected to share the information with the joint holder or legal heir. To be clear nominee will not be the owner of assets but nomination will simply ensure a smooth transmission. The final ownership is determined by the will, or, in its absence, by succession laws.