Max Life Insurance to release findings of Covid-19 through ‘IPQ Express’ survey

Strengthening its commitment towards ensuring greater financial protection for the country in the midst of COVID-19, Max Life Insurance Company Ltd. (“Max Life”/ “Company”) today unveiled the findings of the COVID-19 edition of its flagship survey ‘Max Life India Protection Quotient- express’ (“IPQ/IPQ Express”) in association with KANTAR. Titled IPQ Express, the survey reveals dominant consumer sentiment in the times of COVID-19 on the back of how protected digitally savvy urban Indians feel with respect to financial security, savings and investments, medical preparedness, key anxieties, and new acceptance levels in an increasingly digital world.

The survey revealed a protection quotient of 47 during this period despite a relatively high awareness and better ownership of life insurance products by the digitally savvy, urban respondents. Respondents across metros and Tier I cities, revealed a high Knowledge Index at 68 and life insurance ownership at 79%. Amidst the COVID-19 crisis, half the respondents are feeling attitudinally less secure on financial aspects. The financial security levels were highest in Tier 1 cities with 55% respondents exhibiting attitudinally being more secure, followed by 52% respondents in Tier 2 cities and the lowest in metros at 46%. Women feel less secure at 47% as compared to men at 53%. The percentage of financial security among millennials and non-millennials was almost the same with 51% and 52% respectively.

Commenting on the findings of IPQ Express, Prashant Tripathy, Managing Director and CEO, Max Life Insurance said, “IPQ Express, Max Life’s flagship survey has presented an opportunity to better understand the pulse of consumers in the unprecedented times of COVID-19. Digitally savvy urban India is feeling attitudinally less secure about financial protection in the wake of this crisis. As per the survey, an essential today for over 80% of the households is being proactive about financial planning especially with heightened anxieties around unemployment and untimely death of the family breadwinner. Term insurance has emerged as a preferred life insurance category during Covid-19. Overall, the rich insights from IPQ Express gives us the inspiration to further strengthen our efforts towards financially securing our customers and inspiring them to increase the value of their lives.”

Soumya Mohanty, Managing Director and CCO, Kantar Insights, South Asia remarking on the findings of the survey said, “In the wake of COVID-19 pandemic, people’s attitudes towards savings, investments and the overall idea of financial protection is bound to change. With IPQ Express, we partnered with Max Life to bring to the centerstage this shift in dominant consumer sentiment and explore financial security challenges created by Covid-19 while establishing that prioritizing spending, embracing protection, and planning for the longer term are key to financial stability given the current times.”

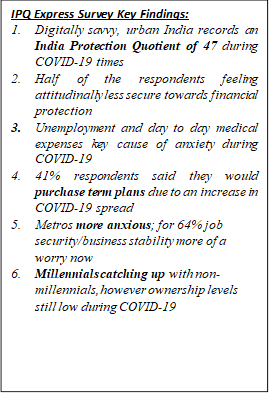

Key Findings

- Digitally savvy, evolved cohort reveals IPQ of 47, but feels attitudinally less secure amidst COVID-19

The survey revealed that a relatively high awareness and better ownership of life insurance products has led the digitally savvy urban India to demonstrate an IPQ of 47 during COVID-19 times. 51% respondents feeling attitudinally less secure towards financial protection during the current uncertain times. While this number was highest in Tier 1 with 55% respondents exhibiting attitudinally more secure followed by 52% respondents in Tier 2; it was lowest in metros at 46%. The percentage of financial security among millennials and non-millennials was almost the same with 51% and 52%, respectively whereas 53% men feeling more secure on financial aspects as compared to 47% women.

- Tier 1 & 2 feel less protected with IPQ of 45 & 43 respectively, but more attitudinally secure than metros

On a metro only level, IPQ is at a higher 49, with knowledge index at 70 points, life insurance ownership at 83% and security level is at a low 46%. In Tier 1 cities, while knowledge index is at 66 points, life insurance ownership is 75% and IPQ stands at a lower 45, respondents feel attitudinally more secure at 55%. Respondents in Tier 2 cities too, feel less financially protected in comparison to metros and Tier 1 with IPQ at 43, but have a higher security level at 52%. Knowledge index of Tier 2 cities is at a comparatively lower 61 point, and life insurance ownership is 71%.

With 52% respondents in metros feeling financially secure about fulfilling basic needs of the family, the numbers are higher at 61% for Tier 1 respondents and 56% for Tier 2 respondents. Furthermore, 56% Tier 1 and 53% Tier 2 respondents feel confident about financial security of the family given untimely demise of the breadwinner as opposed to mere 48% metro respondents who feel secure on said aspect. On job security front too, the financial security level of Tier 1 and Tier 2 respondents is higher at 55% and 53% respectively, whereas respondents in metros feel relatively lesser secure about it at 46%.

- Unemployment and day to day medical expenses key cause of anxiety during COVID-19

Due to COVID-19, the survey found respondents to be more anxious about job security and financial security of family in the absence of a bread winner. While concerns about current business, job security and stability of income is the key worry for digitally savvy, urban respondents at 66%, financial security of family in the absence of a breadwinner is at the same level with 66%. For nearly 65%, day to day medical expenses due to increasing cases of COVID-19 is one of the top anxieties.

- Metros more anxious; for 64% job security/business stability more of a worry now

As households are faced with income decline and increased costs of healthcare, IPQ Express discovered that job security, medical security, and financial security of the family in the absence of breadwinner are more important to people now than before COVID-19.

While 64% respondents in metros said that security of job/current business/ stable income is more of a worry to them now than before COVID-19, only 51% in Tier 1 said it had become more concerning to them. 57% in metros as against 53% respondents in Tier 1 said that financial security of the family in the absence of the breadwinner is more worrying now than before COVID-19. Inadequacy of funds in case of critical illness is a bigger anxiety for 57% respondents in metros as against 49% in Tier 1, as compared to before COVID-19.

- Compared to pre-COVID-19 time, 43% consumers are saving more while basic expenses largely remain same or have gone down

In wake of the current situation, IPQ Express brought to light that in comparison to pre-COVID-19 times, consumers are saving more now, whereas investments and basis expenses have remained the same as before. While savings increased for 48% respondents in Tier 1 and 38% respondents in metros, investments remained the same as before COVID-19 for 44% in Tier 1 and 40% in metros.

- COVID-19 a key trigger for purchase of term insurance, has driven 83% of digitally savvy urban Indians towards proactive financial planning

With 83% respondents on an overall level believing that the situation demands one to be more proactive about financial planning, IPQ Express highlights increase in importance of financial protection. When surveyed intenders, 41% respondents said that they would purchase term insurance plans because with increase in spread of COVID-19, it is important to have financial protection for self and family. IPQ Express revealed that 41% intender respondents also said they intend to buy term insurance to protect their family in case of bread-winner’s untimely death while 37% intenders responded that they would buy term insurance because life is uncertain, and anything can happen anytime.

- Term ownership highest across life insurance product categories during COVID-19 in metros & Tier 1 cities

IPQ Express survey revealed that term insurance ownership was highest across different categories of life insurance products, with 41% metro respondents owning term products against 22% who owned market linked products and 39% who owned endowment products. In Tier 1, the term insurance ownership stands at 37% as against 15% who owned market linked products and 29% who owned endowment products.

- Lack of awareness around cost of premiums and claims paid ratio amongst key barriers to term insurance purchase

IPQ Express survey also revealed that despite the current situation of COVID-19 and its spread in mind, there exist few notable barriers in the way of term plan adoption. While perceived high premiums to be paid is a key barrier for 28 % digitally savvy respondents, 20% respondents feel it is difficult to settle a claim and therefore remain averse to buying term plans.

- 1 in 4 consumers took COVID-19 / Critical illness rider upon realization of getting infected

IPQ Express survey revealed that when confronted by the thought that COVID-19 could prey on the individual and/or family, 31% respondents in metros and 20% in Tier 1 cities said they bought a life insurance with COVID-19/ critical illness rider. While uptake of COVID-19/ Critical illness rider is more in metros than Tier 1, 42% respondents in metros and 37% in Tier 1 said they made other investments and savings in anticipation of the crisis.

- With IPQ at 43, women continue to feel financially less protected than men during COVID-19

Furthermore, IPQ Express survey also revealed notable difference in the levels of financial protectedness of men and women. While the protection quotient for men was at a higher 46 point, women during COVID-19 demonstrated an IPQ of 43. Life insurance ownership and security levels too were lower for women in comparison to men, with 73% women as against 78% owning life insurance and 47% women as against 53% men feeling financially secure.

When asked that keeping the current situation of COVID-19 and its spread in mind, how financially anxious do men and women feel vis a vis various parameters, 59% women in comparison to 50% felt more worried now than before coronavirus about inadequacy of funds to tide over critical illness costs. 58% women in comparison to 54% men are more concerned about their job security/income stability in the current circumstances and 57% women are worried about day to day medical expenses as opposed to just 50% men during COVID-19.

- Millennials catching up with non-millennials, however ownership levels still low

As per the findings of IPQ Express survey, millennials are catching up with non-millennials with their IPQ only a point away at 45, from non-millennials’ at 46. However, when it comes to ownership of life insurance products, a lesser 75% millennials own life insurance in comparison to 80% non-millennials, whereas knowledge index of 66 is at par for millennials and non-millennials. 51% millennials as opposed to 52% non-millennials feel financially secure under current circumstances.