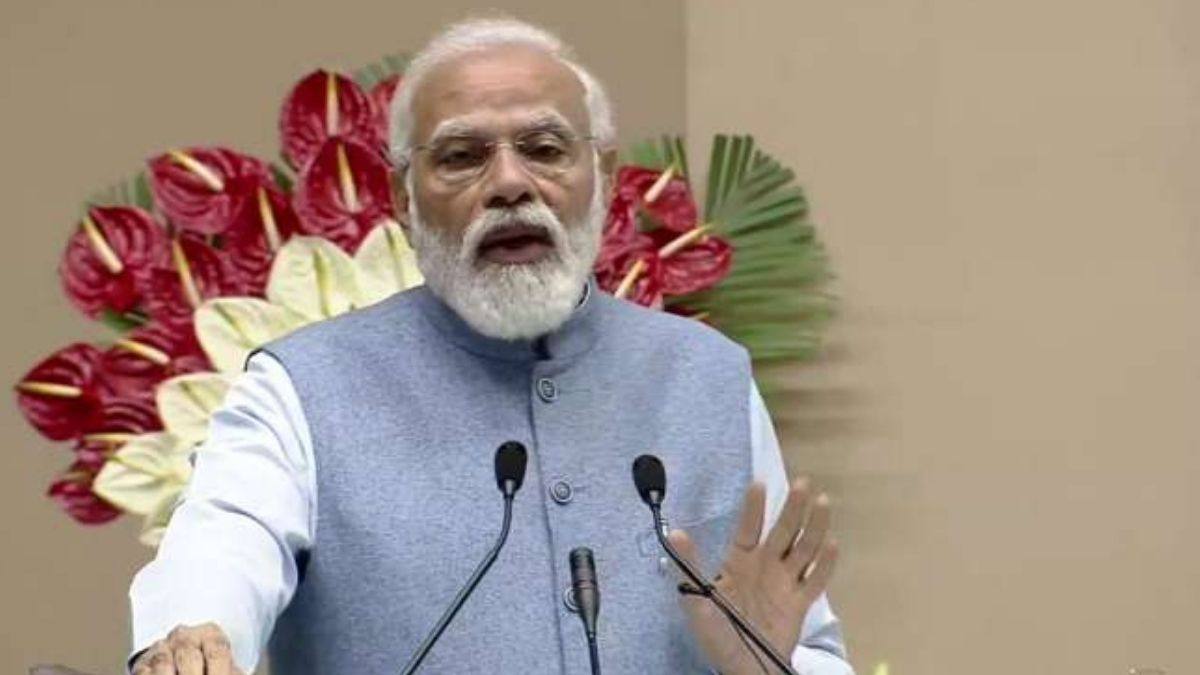

Prime Minister Narendra Modi spoke at the Depositors First: Guaranteed Time-bound Deposit Insurance Payment up to 5 lakh’ programme, Check Out the details!

The Prime Minister of India, Narendra Modi addressed the nation on Sunday and spoke at the ‘Depositors First: Guaranteed Time-bound Deposit Insurance Payment up to 5 lakh’ programme.

He attacked the previous governments by saying that the issues that are not resolved in many last decades are handled by the Narendra Modi led-central government. He addressed the NABARD chairman, Finance minister Nirmala Sitharaman, RBI Governor Shaktikanta Das and others.

The BJP Government has worked to enhance the financial system and introduced reforms to benefit the poor and middle-class individuals in the last 7 years of its regime. Moreover, in the last few days, he claimed that over one lakh depositors got their money back which was stuck in banks for years. It amounted to more than 1300 crore.

Narendra Modi said, “For years, the attitude of slipping the problems under the carpet was prevalent in our country. Our middle and poor class have time and again suffered from the banking crisis. But today’s new India is determined on resolving these problems.”

He added, “Today is an important day for the banking sector and account holders. Today symbolizes the fact that the government has always kept the ‘Depositors First’. Depositors first, the name of this programme reflects our priority and responsibility towards them and their needs.”

Talking about the achievements, he said, “We have increased the cap from Rs 1 lakh to Rs 5 lakh for these depositors to make the most out of this opportunity and build a sense of trust among our depositors.”

Shaktikanta Das also said, “The country has demonstrated of working together during this COVID pandemic. India’s moment has come where India can really become a gross driver of the world economy. That will be possible if all stakeholders in the banking sector work together.”

The government also enables the deposit insurance coverage of ₹5 lakh per depositor per bank and also led to the growth in the number of fully protected accounts at the year of last financial year to 98.1 percent of the total number of accounts.