IRCTC STock: Funny memes appear after the stock has plummeted 32%

Experts argue that this is not the case. Though they do not recommend that investors accumulate the company, they do recommend that long-term investors keep it since the fundamentals are still solid. They claim that what we’re witnessing is a technological glitch.

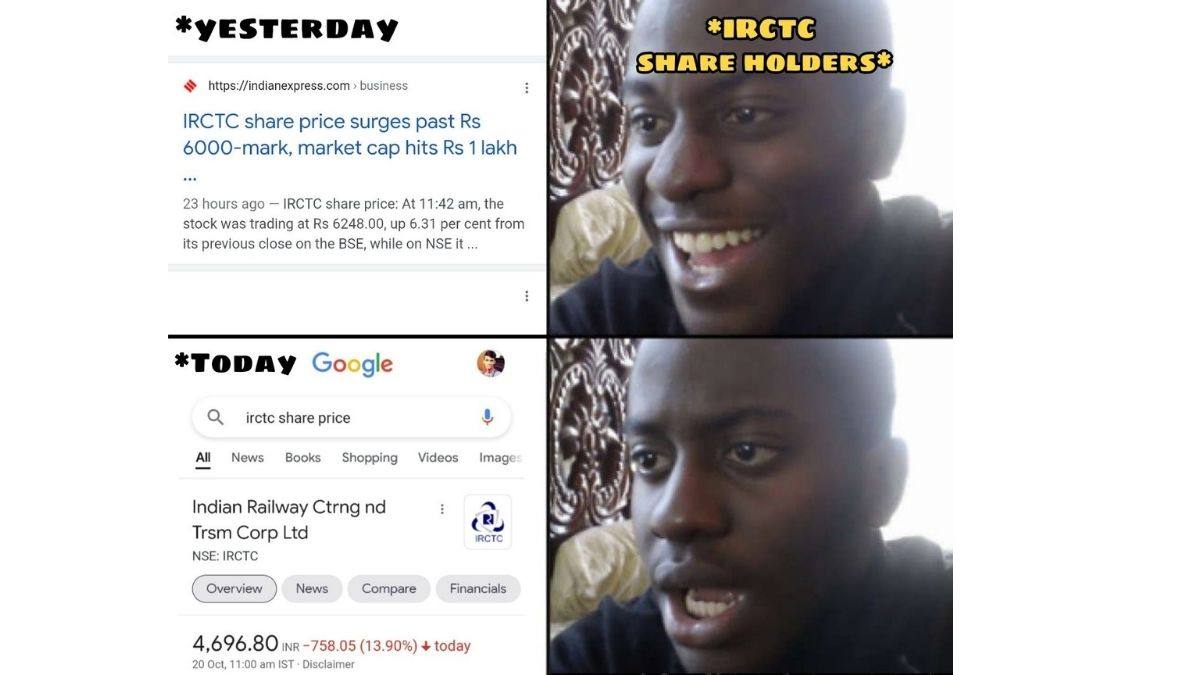

After touching a record high of Rs 6,396.30 on October 19, the Indian Railway Catering and Tourism Corporation (IRCTC), which has a monopoly in the segments it operates, fell 32% in two trading days.

The Indian Railways has authorised IRCTC to provide culinary services, online ticketing, and bottled drinking water at railway stops and inside trains.

The stock has risen 218 percent in the previous four months, owing to the country’s progress toward complete unlocking, as well as a decrease in COVID cases and a successful vaccination campaign.

IRCTC dropped 18.5 percent intraday on Wednesday, and 16.2 percent from its record high on Tuesday. In the previous session, the stock had a market capitalization of Rs 1 lakh crore.

‘The IRCTC is witnessing a technical error.’

According to experts, the stock’s fundamentals are still sound, and the drop stemmed from its overvaluation. As a result, it’s referred to as a technical correction. Long-term investors are advised to remain calm and retain the stock.

The fundamentals, according to Santosh Meena, Head of Research at Swastika Investmart, are still solid. “However, after such a long run, there is concern about value, and there was an obvious speculative move, since it was simple for traders to make money every day. As a result, we’re witnessing a technical correction, with Rs 4,000-3,800 serving as a crucial demand zone for new buying opportunities.”

“IRCTC’s stock has soared in recent months as a result of investors’ interest in the unlock theme, which comprises firms that are likely to profit from the economy’s normalisation. Its downward trend has abruptly reversed. We do not recommend purchasing on the cheap or accumulating at present prices “CapitalVia Global Research Senior Research Analyst Likhita Chepa stated.

Long-term investors should consider retaining the stock because it has a monopoly in its sector of business and has good prospects, she suggested, and should resist panic selling.

MFs are lowering their shareholding in the IRCTC.

Mutual funds cut their shareholding in IRCTC from 7.28 percent in the June 2021 quarter to 4.78 percent in September 2021. In the September quarter’s shareholding pattern, the names of Nippon Life India Trustee and Aditya Birla Sun Life Trustee did not appear.

In the same period, foreign portfolio investors reduced their ownership to 7.81 percent from 8.07 percent, but LIC increased its investment to 2.11 percent from 1.9 percent.

Individual owners owning less than Rs 2 lakh in shares grew their position to 14.17 percent from 11.26 percent in the previous quarter, whereas high net worth people dropped their stake to 0.14 percent from 0.22 percent.

Here are some memes that made it everyone laugh out loud:

Irctc investors Before and Today.#IRCTC #Investment #StockMarket #INTRADAY pic.twitter.com/rcbg00PFTd

— StoxBazar (@stoxbazar) October 20, 2021

People who brought #IRCTC share #StockMarket pic.twitter.com/wbs69fPRdw

— faiz_22 (@faiz_____22) October 20, 2021

#IRCTC's share holders reaction rn:#StockMarket #irctcshare pic.twitter.com/4gk3fbBmDO

— faiz_22 (@faiz_____22) October 20, 2021

after seeing #IRCTC price boht hard boht hard #StockMarket pic.twitter.com/O54GfVJ1rQ

— zooby✨ (@zooby_ravan) October 20, 2021